by Bruce Grieve | Jun 17, 2022 | Articles, Updates

Recently, Bruce Grieve met with a couple who were looking to retire within the next year or two and, although we would ideally start the planning well before this, even at this late stage we were able to take advantage of a number of opportunities. Although they are...

by Teigan Amos | Jun 15, 2022 | Articles, Business Advice, Updates

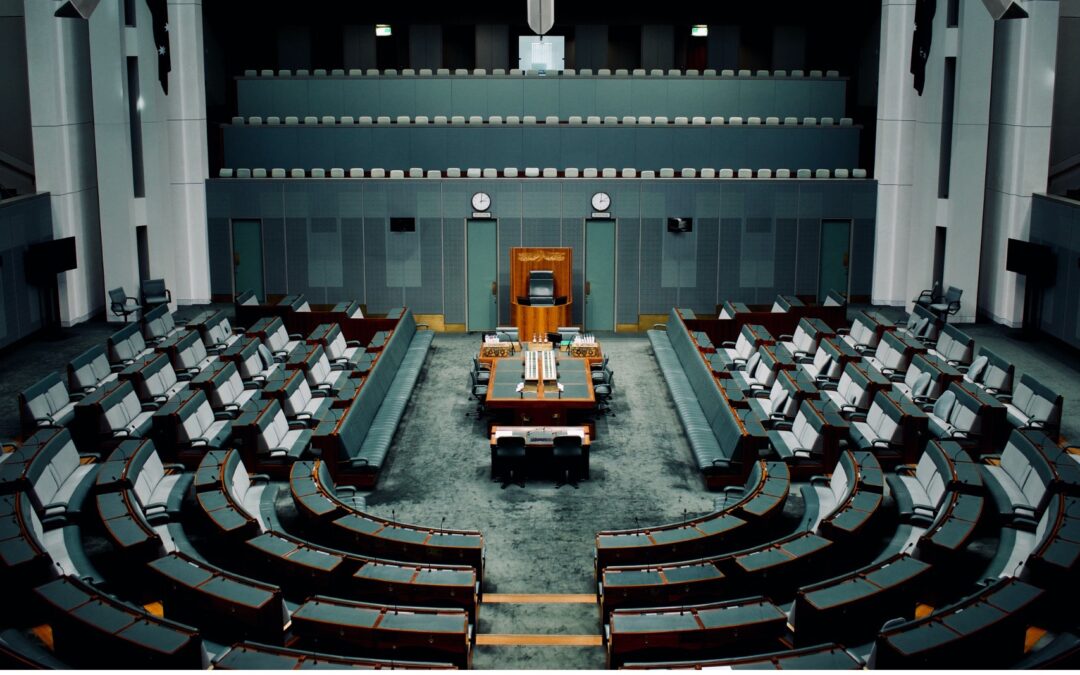

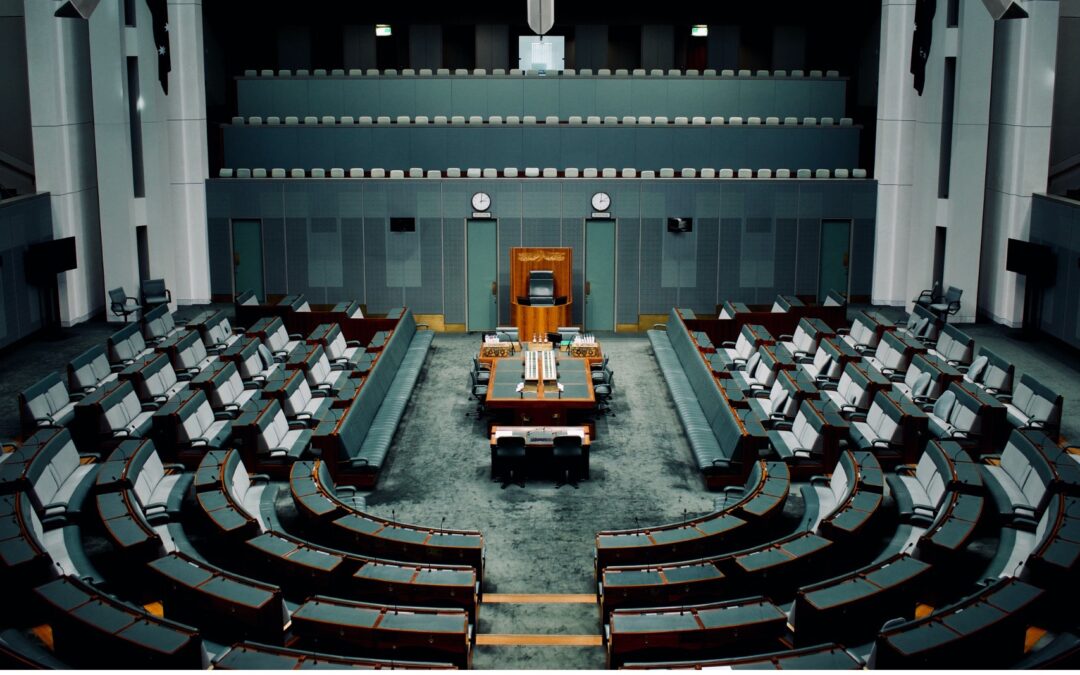

Anthony Albanese has been sworn in as Australia’s 31st Prime Minister and a Government formed. We look at what we know so far about the policies of the new Government in an environment with plenty of problems and no easy fixes. The economy The Government has stated...

by Teigan Amos | Jun 15, 2022 | Articles, Business Advice, Updates

The ATO has not pursued many business tax debts during the pandemic and allowed tax refunds to flow through even if the business had a tax debt. That position has now changed and the ATO has resumed debt collection and offsetting tax debts against refunds. If you...

by Teigan Amos | Jun 15, 2022 | Articles, Business Advice, Updates

The ATO has flagged four priority areas this tax season where people are making mistakes. With tax season almost upon us the Australian Taxation Office (ATO) has revealed its four areas of focus this tax season. Record-keeping Work-related expenses Rental property...

by Teigan Amos | May 13, 2022 | Articles, Updates

The Government temporarily halved the excise and excise equivalent customs duty rates for petrol, diesel and all other petroleum-based products (except aviation fuels) for 6 months from 30 March 2022 until 28 September 2022. This has caused a reduction in fuel tax...

by Teigan Amos | May 13, 2022 | Articles, Updates

Throughout March, the ATO sent letters to directors who are potentially in breach of their obligations to ensure that the company they represent has met its PAYG withholding, superannuation guarantee charge, or GST obligations. These letters are a warning shot and...