What the ATO Expects of Your Records

Income Tax records

If you are carrying on a business, you need to keep records explaining all transactions that relate to your tax affairs.

These records include:

- Sales and expense invoices

- Sales and expense receipts

- Cash register tapes

- Credit card statements

- Bank deposit books and cheque butts

- Bank account statements

Sales and expense invoices and receipts should show such things as the:

- Name of the supplier

- Australian business number (ABN) of the supplier

- Amount of the sale or expense

- Nature of the goods or services sold or purchased

- Date of sale or date the expense was incurred

- Date of the document

If your business buys or sells stock, you usually need to do a stocktake at the end of each income year. Where you do a stocktake, your records should include:

- A list describing each article of stock on hand and its value

- Who did the stocktake

- How and when it was done

- Who valued the stock and the basis of the valuation

GST records you must keep

You must keep records of all your sales and purchases to prepare your activity statements. To claim GST credits, you must have special GST records called tax invoices that record your purchase of goods or services and comply with the GST law. You must have a tax invoice to claim a credit for the GST included in the price of any goods and services you buy for your business that cost more than $82.50, including GST.

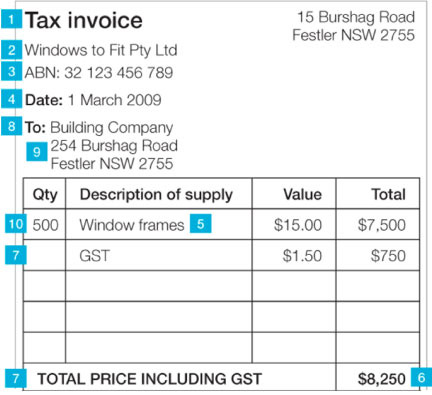

Tax invoices for amounts less than $1,000 must include:

- The words ‘tax invoice’

- Supplier’s name

- ABN of the supplier

- Date of issue

- Description of each thing supplied

- Total price, including GST

- Statement that the total price includes GST (or GST shown separately) Tax invoices for amounts of $1,000 or more must have all the above, plus the:

- Purchaser’s name

- Purchaser’s ABN or address

- Quantity of the things supplied

PAYG withholding records you must keep

For PAYG purposes you must keep:

- Declarations you obtain from employees, including withholding variation notices

- Worker payment records

- Payment summaries

- Annual reports of amounts you have withheld

Super records you must keep:

Superannuation guarantee

You must keep records that adequately explain your super transactions, including documents that show how you calculated the amount of super you contributed for each employee. You should also keep records that affect the amount of super you must contribute. This may include advice you have received from trustees about the funds you contribute to.

Choice of super fund

You need to keep records that show you’ve met your choice of super fund obligations. These include:

- Details of employees who do not have to be offered a choice of super fund

- Records confirming that the super fund meets the insurance requirements

- Records showing that you have provided the Choosing a Super Fund – How to complete your standard choice form to all eligible employees

- Written information an employee provided when they nominated their chosen fund or retirement savings account

- Receipts or other documents issued by funds showing that you have made super contributions for employees to their chosen fund.

FBT records you need to keep

You need to keep records that show:

- the taxable value of each fringe benefit provided to each employee. Some examples of records you may need to keep are invoices, receipts, travel diaries, logbooks, odometer records and employee declarations

- the method you used to allocate the taxable value of a fringe benefit you provided to two or more employees.

- that 100% of the taxable value of the benefits has been allocated to employees

Fuel tax credit records you must keep

The records you currently keep for your business will generally support your claims for fuel tax credits. Your records should show that you:

- acquired the fuel

- used the fuel in your business

- calculated the number of litres used for the appropriate creditable purpose

- applied the correct rate when calculating how much you could claim.

In General

By law, you must keep business records:

- for five years after they are prepared, obtained or the transactions completed, whichever occurs latest

- in English or in a form that we and the ATO can access and understand in order to work out the amount of tax you are liable to pay

At Bentleys, we are here to ensure you are maintaining your records within the requirements of the ATO, as well as streamlining that process as much as possible so that it has the least impact possible on you and your business.